The Chancellor of the Exchequer, Rachel Reeves, has announced that, from winter 2024/25, households in England and Wales will no longer be entitled to the winter fuel payment unless they receive pension credit or certain other means-tested benefits.

More than 10 million pensioners in England and Wales received the winter fuel payment for winter 2023/24 and therefore an estimated 10 million will be adversely impacted.

The current winter fuel payment is:

-

£200 for households where the oldest person is under 80;

-

£300 for households with someone aged 80 or over.

The decision is expected to save around £1.3 billion in 2024/25 and £1.5 billion in subsequent years.

However, the proposals leave many pensioners in a position where they must choose to heat or eat this winter. The policy change has not been impact assessed by the Labour Party.

Basing eligibility on receipt of means-tested benefits creates a ‘cliff edge’ where people who just miss out on benefits lose support completely.

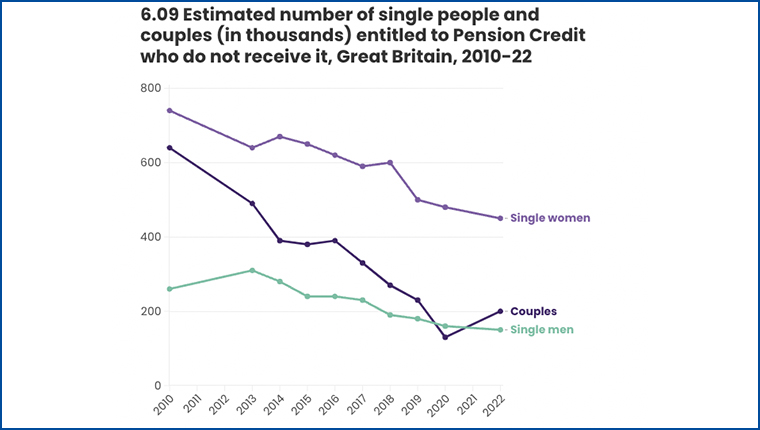

Pensioners eligible for, but not claiming, pension credit would also lose the winter fuel payment. Take-up of Pensions Credit has been a real issue and there are also concerns around the Department for Work and Pensions (DWP) being able to process claims.

Winter fuel payments are devolved in Scotland and Northern Ireland. The Scottish Government and the Northern Ireland Executive have announced that due to funding cuts, they have no choice but to follow the UK Government’s decision to restrict payments.

Pension credit

Pension credit is a means-tested benefit for people over state pension age who have a low income and has the effect of topping up their pension.

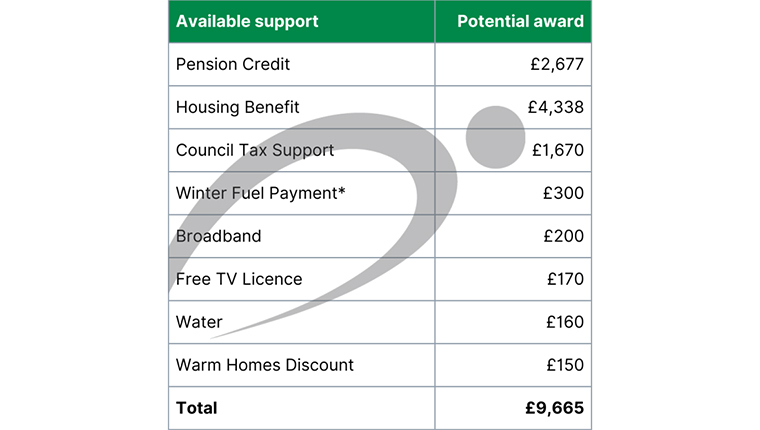

Pension credit is a valuable benefit, worth £2,677 a year on average to eligible people. Anyone who qualifies for pension credit may also be entitled to other financial support, housing benefit, a reduction in council tax, or help with heating costs through winter fuel payments/warm homes discount.

Pension credit tops-up weekly income to (April 2024):

- £218.15 if you’re single;

-

£332.95 if you’re a couple.

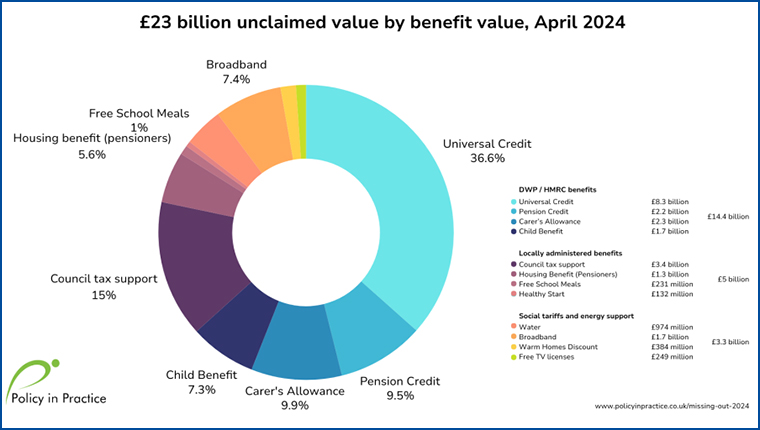

More than 850,000 older people are eligible for but not claiming pension credit. An estimated 130,000 older people miss out because they are just £500 over the income threshold to claim pension credit. [1] They could be better off by having lower income and claiming pension credit and the winter fuel payment.

The DWP has reported a huge surge in applications recently, more so due to the cost of living and energy crises and state pension announcement on winter fuel payments being restricted.

The DWP has reported 38,500 pension credit claims were submitted within the last five weeks. This is a 115% increase on the claims made in the previous five weeks. [2]

Recent changes announced to the winter fuel payment mean that eligible pensioners will miss out on this support if they don’t claim pension credit before 21 December 2024.

State pension 2025/26

It has been announced that the new full state pension will be boosted above inflation by £460 a year in cash terms due to the triple lock. Under the triple lock, state pension is likely to be increased by earnings. Earnings figures from the Office for National Statistics (ONS) released on 10 September 2024 showed that total wage growth increased by 4%, which is likely to be higher than CPI September 2024 (released 10 October 2024) or 2.5%.

Experts believe CPI inflation (currently 2.2% in July 2024) is unlikely to outstrip wages, so the new state pension should rise by 4% next April. Therefore, the state pension will grow by 4%.

This increase will take the full state pension for men who were born after 1951 and women born after 1953 to around £11,963 (2025/26) or £230.05 per week and an increase of approximately £8.85 per week after a £900 increase last year (2023/24).

Under the old regime for pre-6 April 2016, retirees will receive an annual increase of approximately £353.60, £176.30 per week from £169.50 (an increase of £6.80 per week), taking the basic state pension to around £9,167.60 next year (2025/26).

The additional earnings-related element of the basic state pension S2P, SERPS and/or graduated pension, top-ups etc. are only increased in line with the rate of CPI inflation (September CPI released 10 October 2024) and not the triple lock. Therefore, some will find their overall state pension increase lags behind the 4% figure.

The final decision on uprating of state pensions will be made by the Pensions Secretary, Liz Kendall, ahead of the Budget on 30 October 2024, but the Chancellor reiterated the Government’s backing for the triple lock until the end of this parliament, saying, ‘Those who work hard should be able to live a good life in retirement. Those are Labour’s values.’

| 2024/25 (£ pw) | 2025/26 ( £ pw) | Change (£ pw) | 2024/25 (£ pa) | 2025/26 (£ pa) | Change (£ pa) | |

|---|---|---|---|---|---|---|

| Old basic pension | £169.50 | £176.30 | +£6.80 | £8,814 | £9,167 | +£353 |

| New state pension | £221.20 | £230.05 | +£8.85 | £11,502 | £11,962 | +£460 |

Inflation

Pensions industry experts have argued that the £8.85 per week would be eroded by inflation in part and that it would only amount to around £5 per week in real terms.

Former pensions minister Steve Webb has stated that the new state pension would need to rise by just over £250 just to keep up with inflation. He further says that only about £210 over the £460 increase represents a real increase and this is before allowing for the income tax which most pensioners will pay on their state pension rise.

Furthermore, he mentions that those who lose £200 or £300 in winter fuel payments will still be worse off in real terms next April. The rate rise of £460 may not, therefore, be enough to offset the winter fuel allowance being means-tested.

Income tax

Income tax thresholds had been frozen by the previous Tory Government and Labour have agreed to keep these frozen until 2028. The threshold of £12,570 (2023/24) therefore still applies, meaning any personal income over £607 for those in receipt of the full state pension is likely to be taxed unless thresholds also change next year.

Therefore, it is likely that many pensioners are caught within the tax threshold and liable for tax. Many pensioners who rely solely on the state pension may bizarrely have to pay some of it back in income tax. Pensioners would only have to earn an extra income of £607 a year before their personal allowance is exhausted and they become liable for income tax.

The new state pension of £11,963 will equate to 95% of the personal allowance, currently frozen at £12,570 until 2028. By contrast, in 2021/22, the new state pension was equivalent to 74% of the allowance.

Consultation

The Labour Government, as part of its manifesto, promised to review the current state of the pensions and retirement savings landscape to check whether the current framework can deliver sustainable retirement incomes for people.

The Government’s upcoming pension review will examine in some detail the adequacy of both state and private pensions.

NASUWT will be responding to the government on its ongoing plans for pension policy and strategy, especially on the fairness, adequacy and value of pensions so that they allow for dignity in retirement and prevent pensioners falling back on state welfare.

Footnotes

[1] https://policyinpractice.co.uk/2024-unclaimed-pension-credit-value-by-local-authority/

[2] https://www.gov.uk/government/statistics/weekly-pension-credit-claims-received-from-1-april-2024-to-1-september-2024/weekly-pension-credit-claims-received-from-1-april-2024-to-1-september-2024

Your feedback

If you require a response from us, please DO NOT use this form. Please use our Contact Us page instead.

In our continued efforts to improve the website, we evaluate all the feedback you leave here because your insight is invaluable to us, but all your comments are processed anonymously and we are unable to respond to them directly.